Congressional Budget Office on inequality in America

The Congressional Budget Office (CBO) regularly analyzes wealth and income inequality in the U.S., consistently finding that inequality has increased significantly over the past several decades. Federal transfers and taxes reduce inequality, but much of the imbalance persists even after these are factored in.

Wealth inequality

In a recent analysis of family wealth from 1989 to 2022, the CBO highlighted the uneven distribution of wealth.

- Growing disparity: Wealth inequality increased over the period from 1989 to 2022, with a particularly sharp rise between 1989 and 2019.

- Wealth concentration: By 2022, families in the top 10% of the wealth distribution held 60% of the nation’s total wealth, while the bottom 50% held just 6.4%.

- Recent trends: Between 2019 and 2022, wealth inequality remained largely unchanged, with the top 1% of families continuing to hold 27% of all wealth.

Income inequality

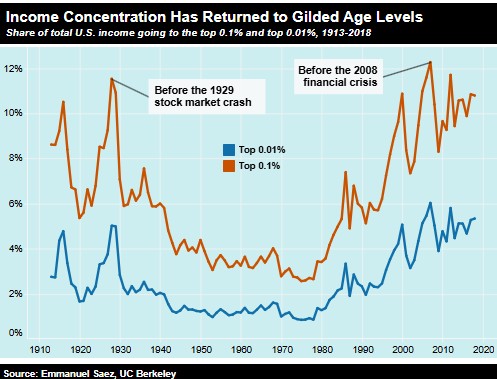

CBO reports examining household income have also detailed an increasing gap between top earners and the rest of the population, especially since 1979.

- Dominant income growth at the top: Income growth has been far more substantial for households at the top of the income distribution. Between 1979 and 2019, the average real income for the highest-earning quintile grew by 114%, compared with just 45% for the lowest quintile and 43% for the middle three quintiles.

- Top 1% income share: The CBO reported that in 2021, the top 1% of households received 21% of all income before transfers and taxes.

- Volatility of capital income: The CBO notes that capital income, which heavily influences the earnings of the wealthiest households, is more volatile and drives significant annual income fluctuations at the top of the distribution.